Google's clarification about the status of the Google Wallet app in India comes amidst some confusion among users. While the app has appeared on the Google Play Store for some users in India, Google has confirmed that the official launch has not yet occurred. This announcement is crucial for users who are looking forward to using the app's features but may be unsure about its current availability and functionality.

Key Features of Google Wallet:

-

Contactless Payments: Google Wallet allows users to make secure contactless payments by tokenizing their credit and debit cards. This means the actual card numbers are replaced with unique codes or virtual cards, enhancing security during transactions.

-

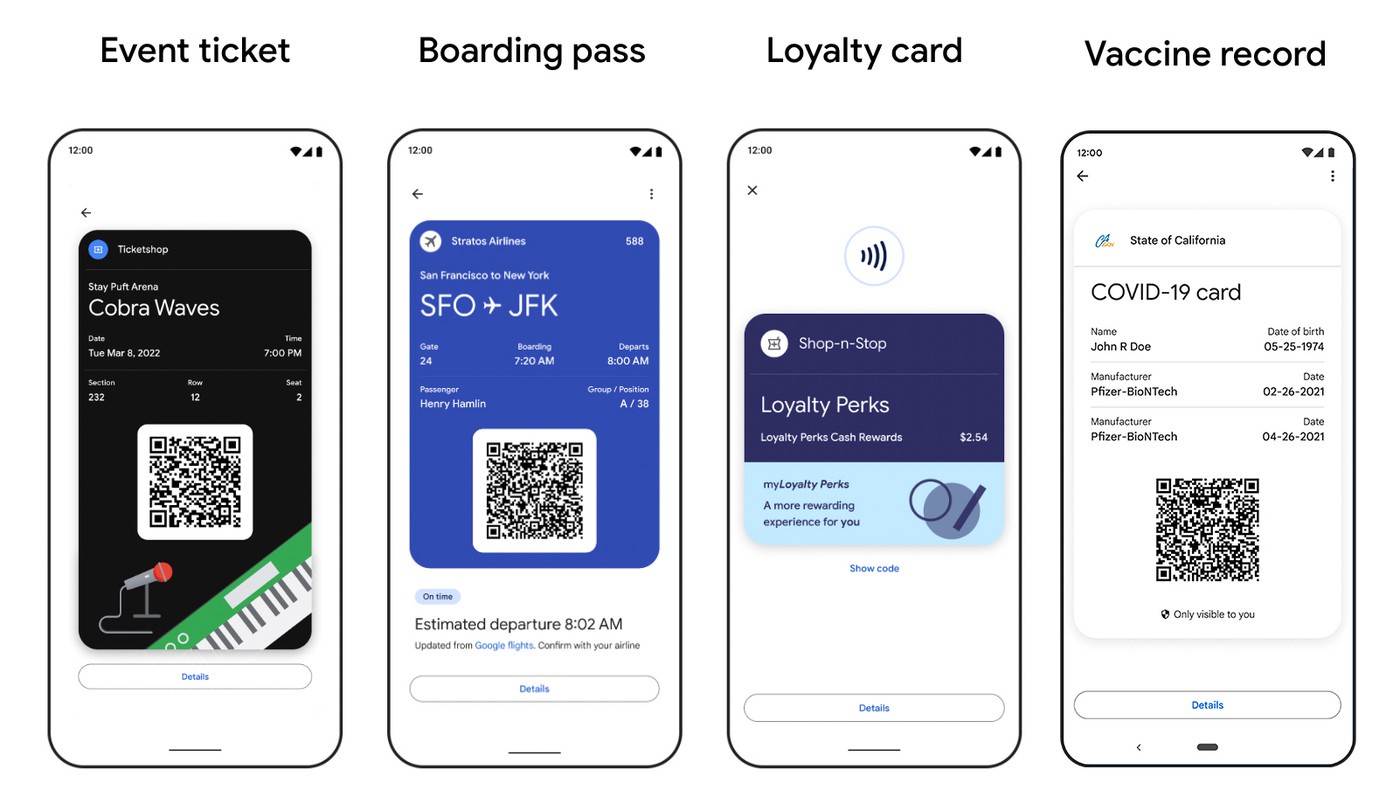

Digital Wallet Capabilities: Beyond contactless payments, Google Wallet serves as a comprehensive digital wallet where users can store various passes such as gift cards, gym memberships, event tickets, and flight tickets.

-

Device Compatibility: The app requires smartphones that support Near Field Communication (NFC) to make contactless payments. This feature limits the app's usability to devices equipped with NFC technology.

-

Integration with WearOS: Google Wallet extends its functionality to wearable technology. Users with compatible WearOS-powered smartwatches can download and use Google Wallet for contactless payments directly from their watches.

-

Pass Addition and Management: Users can add passes to Google Wallet automatically from Gmail, which streamlines the management of digital passes. Additionally, the app supports biometric verification, such as fingerprint scans, to authenticate payments, adding an extra layer of security.

Comparison with Google Pay:

It's important to note the distinction between Google Wallet and Google Pay, especially for users in India:

- Google Pay: Primarily used for Unified Payments Interface (UPI) transactions in India, Google Pay facilitates instant money transfers and bill payments using UPI IDs or QR codes.

- Google Wallet: Focuses on contactless payments using tokenized credit/debit cards and does not support UPI-based transactions.

Future Outlook and User Implications:

Google's decision to offer both Google Wallet and Google Pay caters to diverse user needs in India, providing options for both UPI transactions and contactless payments via NFC. The dual-app strategy allows Google to cover a broader spectrum of financial transactions, appealing to a wider audience with varying preferences and technological capabilities.

For users eagerly awaiting the full functionality of Google Wallet in India, it is advisable to stay updated through official Google announcements to avoid potential confusion about the app's availability and features. Users should also ensure their devices are compatible, particularly in terms of NFC support, to fully utilize the app once it officially launches.