Nvidia’s meteoric rise in market value has once again put the tech world on notice. On Thursday, the AI chipmaker reached a valuation of 3.92 trillion dollars, putting it within striking distance of becoming the most valuable company in history. While the record is still held by Apple’s previous high of 3.915 trillion dollars, Nvidia’s rapid climb illustrates the scale of investor enthusiasm for companies at the center of the artificial intelligence revolution.

Shares of Nvidia jumped to a high of 160.98 dollars before settling slightly lower, keeping its valuation just under Apple’s historical peak. Still, the current market cap of 3.89 trillion dollars places Nvidia ahead of Microsoft and firmly establishes it as a dominant force in global tech. Nvidia now makes up nearly 7 percent of the S&P 500 index, a reflection of how deeply embedded the company has become in both institutional portfolios and AI infrastructure.

What makes this surge even more remarkable is how quickly it has unfolded. Just four years ago, Nvidia’s market value stood at around 500 billion dollars. Since then, the company’s hardware has become the essential foundation for training and deploying large artificial intelligence models, with massive demand pouring in from Microsoft, Amazon, Meta, Alphabet, and other tech giants. These companies are in a race to build the most powerful AI data centers in the world, and Nvidia is supplying the engines to drive that competition.

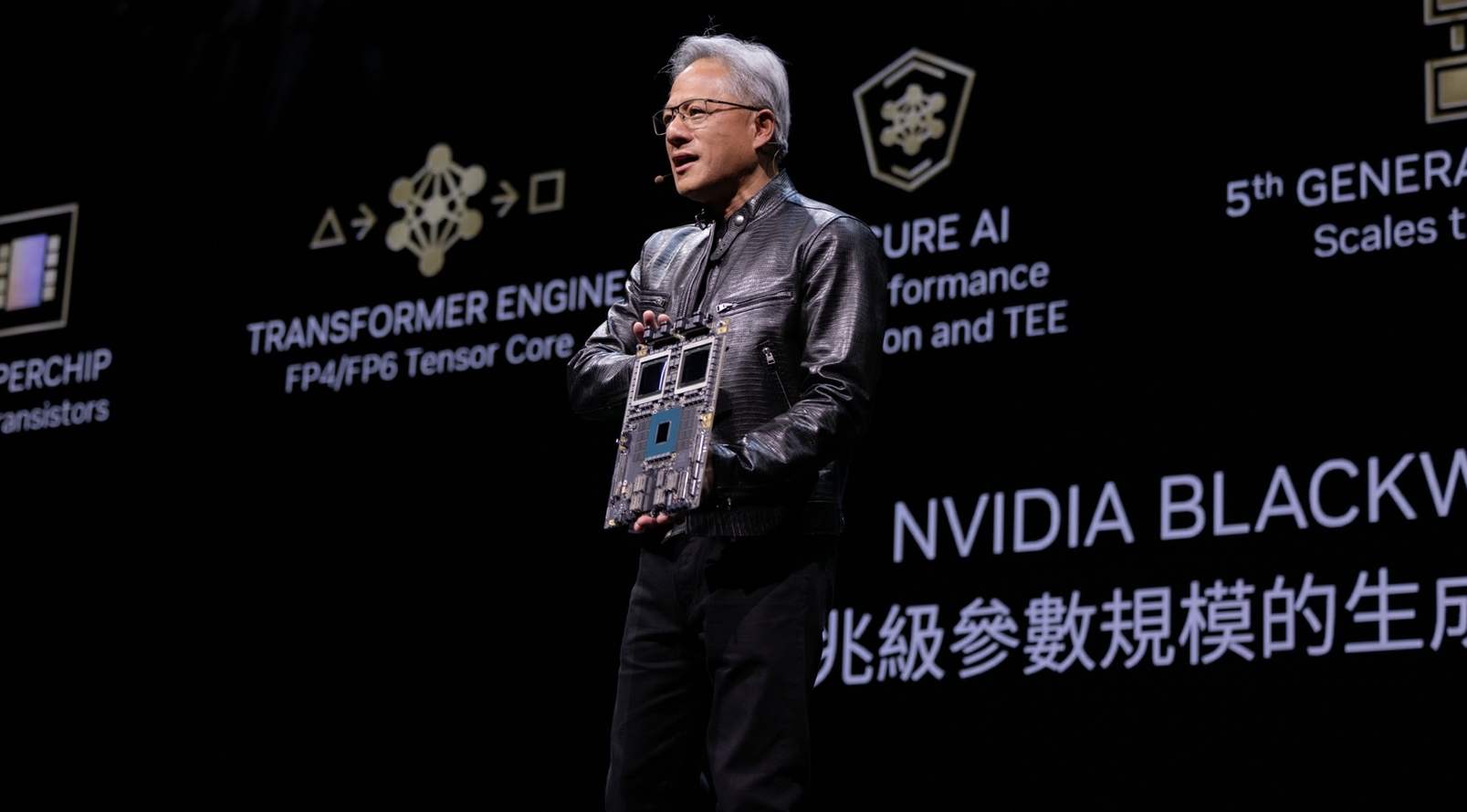

Analysts point to the consistent evolution of Nvidia’s chip technology, such as the RTX 5050 and 5060 series, as critical components behind its stock rally. The company’s GPUs, once reserved for gamers, are now indispensable for data centers, generative AI systems, and machine learning tools being used across industries. Wall Street is betting big on this transformation. Nvidia’s price to earnings ratio has also been dropping, not because the stock is falling but because earnings are rising so fast that valuation metrics are beginning to look modest.

Nvidia’s dominance is also having a global impact. Its total value now exceeds the entire Canadian and Mexican stock markets combined. It is also more valuable than all publicly listed companies in the United Kingdom. This scale places Nvidia in a rarefied league, one that only a few companies in history have approached.

Despite these massive gains, some voices in the financial sector urge caution. Experts like Kim Forrest from Bokeh Capital Partners argue that while AI is clearly productive, the current delivery models may not fully justify the hype and the valuation surge. Still, investors seem unfazed, especially as Nvidia’s rebound from early year volatility continues to impress.

The company, founded in 1993 by Jensen Huang, has evolved from a niche graphics hardware manufacturer to a bellwether for the AI age. It has now become the leading indicator of how deeply AI is influencing financial markets, technological innovation, and investor priorities.

As Wall Street and the global tech ecosystem continue to focus on artificial intelligence as the next frontier, Nvidia remains at the heart of that shift. Its rise is not just about stock prices but about how central it has become to the technologies shaping tomorrow.

For more updates on game changing tech and AI breakthroughs, follow Tech Moves on Instagram and Facebook.