Artificial Intelligence is no longer a buzzword in the financial sector. It is a strategic necessity. As AI spending in global financial services is expected to triple from forty five billion dollars to one hundred twenty six billion dollars by 2028, the industry is undergoing a fundamental transformation. From customer service to compliance, AI-powered tools are unlocking new efficiencies, enhancing decision-making, and reshaping how banks operate both in the front and back end.

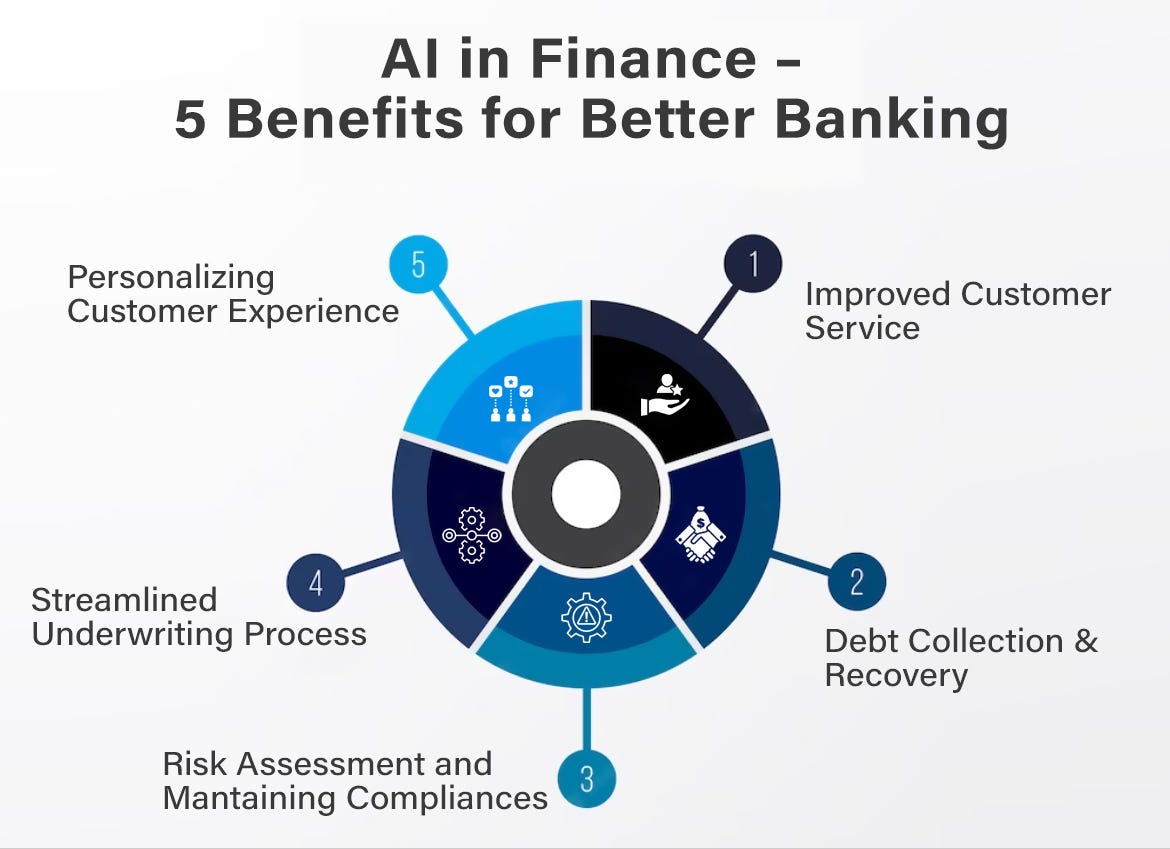

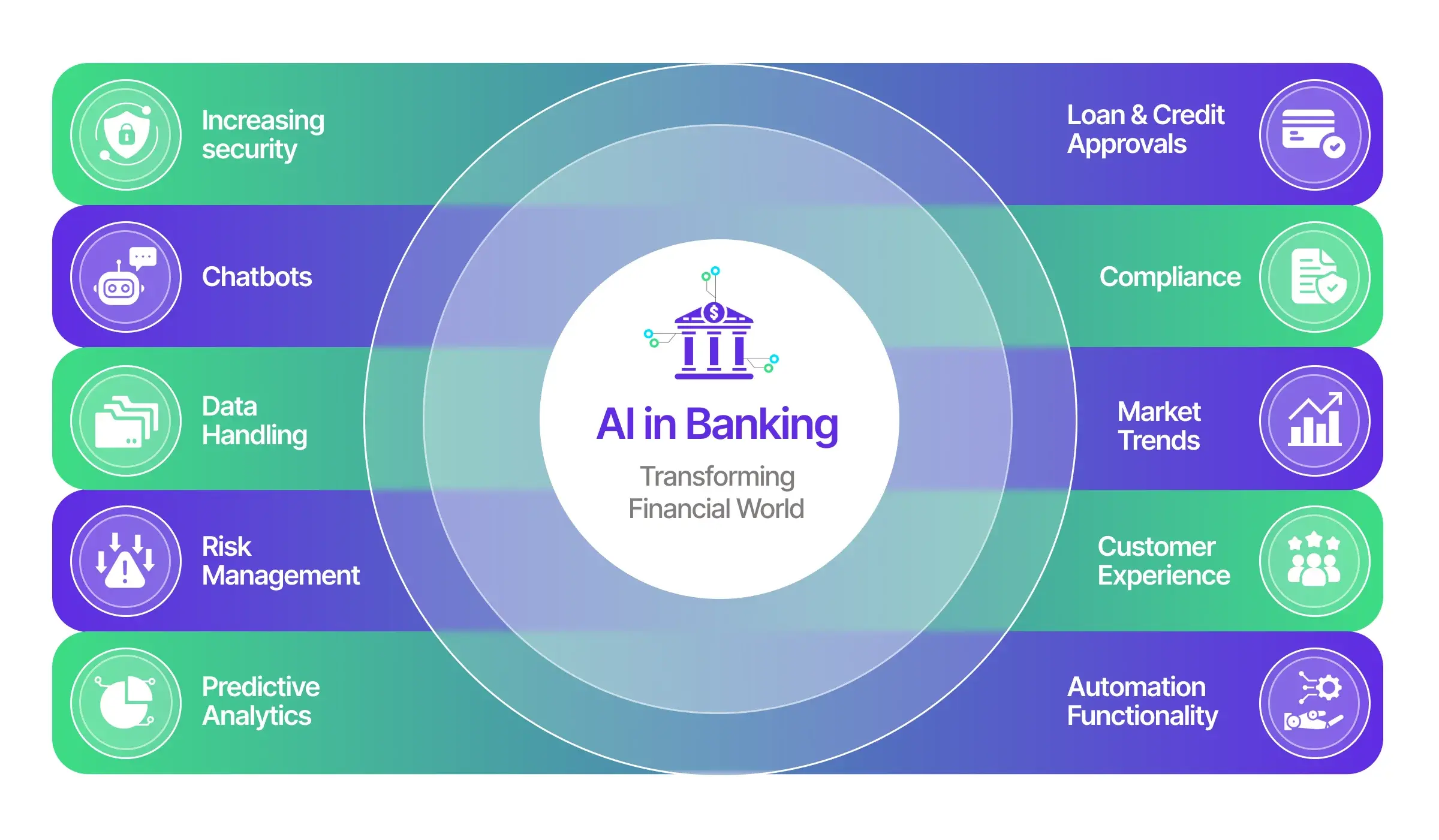

At the core of this revolution is operational efficiency. AI is automating processes that once required time-consuming manual work. Tasks like data entry, transaction processing, identity verification, and reconciliation are now being handled faster, more accurately, and at a lower cost. In customer-facing roles, AI systems are reducing wait times, improving query resolution, and allowing human agents to focus on more complex issues. This automation is not just about saving money. It is about enabling faster service delivery and elevating customer experience.

But AI’s real game-changing impact lies in its ability to generate deep, real-time insights from massive datasets. With machine learning models that continuously learn and improve, financial institutions are now able to hyper-personalize services, forecast liquidity needs with greater accuracy, and reduce idle cash. Predictive models help banks stress test their operations, simulate future scenarios, and manage financial flow based on internal data and external variables.

Risk management has also become smarter. AI is enabling banks to assess creditworthiness using unconventional indicators like utility payments, rental history, and even social media behavior. This opens up access to credit for people who lack formal credit scores. Meanwhile, for more traditional risks such as market fluctuations or currency instability, AI models can flag vulnerabilities and recommend preventive measures.

Fraud detection is another critical area where AI shines. With real-time pattern recognition and anomaly detection, AI can catch suspicious transactions, login attempts, or data breaches before they cause damage. These tools grow more accurate over time, helping institutions minimize financial losses while also reducing false alarms.

In regulatory compliance, which has often been a resource-heavy challenge, AI is proving to be a strong ally. Financial institutions are using AI to automate reporting, monitor regulatory updates, and maintain detailed audit trails. This not only improves adherence to current mandates but also positions banks to stay ahead of evolving compliance requirements.

Perhaps most importantly, AI is enabling financial institutions to become more resilient. By analyzing operational data, predicting potential disruptions, and accelerating response strategies, AI tools are enhancing business continuity and preparing banks for an unpredictable future.

However, the journey is still far from complete. Many banks have implemented AI in isolated silos without a comprehensive integration plan. This fragmented approach limits the true potential of intelligent technologies. To truly harness the benefits, financial institutions need to embed AI across core operations, supported by scalable infrastructure, a solid data framework, and a culture that supports collaboration between humans and machines.

The future of finance will be shaped by how deeply and wisely institutions invest in AI. It is not about replacing human intelligence, but about amplifying it. And as this transformation unfolds, those who integrate AI with purpose and vision will lead the next generation of financial innovation.

Follow Tech Moves on Instagram and Facebook for more insights on how intelligent tech is shaping the future of banking and beyond.